Some People Are Down on the Economy — Here’s Why We Should Care

When you ask people how they’re doing, you often get a knee-jerk “fine” or “good” without much introspection. But lately, when you ask people about the economy, they have clear feelings.

Over the past several years, the economy has been remarkable, in a literal sense; there has been a lot to talk about. Inflation rose to levels we hadn’t seen in about 40 years, and home prices climbed roughly 50%. The Federal Reserve stepped in to fight inflation. Interest rates reached territory they hadn’t touched in 20 years or more, but they did so without triggering a recession. Economic growth has remained high and the labor market strong. All of these factors have resulted in a cacophony of narratives about the economy, which is very likely playing a role in people’s perceptions.

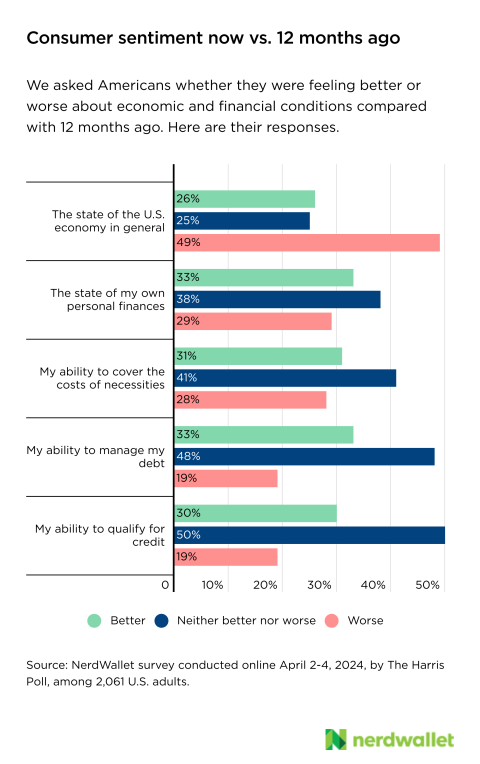

A new survey from NerdWallet, conducted online by The Harris Poll among more than 2,000 U.S. adults, reveals a disconnect that illustrates these perceptions well. When asked how they feel about a variety of economic and financial topics now compared with 12 months ago, Americans were nearly twice as likely to feel worse than better about the state of the U.S. economy in general. Yet they were slightly more likely to feel better than worse about the state of their own personal finances.

Over the past 12 months, the survey period we asked about, the economy has actually remained strong, and the post-pandemic recovery has carried on better than expected. Consumers continue spending, which is typically taken as a sign of confidence. It may be tempting to disregard negative sentiment if we can’t confirm it’s rooted in current economic reality. But that sentiment may provide clues to yet-unseen problems and potentially drive behavior changes that could have significant economic impact.

Half of Americans are feeling worse about the economy

People’s perceptions are colored by their background, personality traits and exposure to information, among many other things. And these perceptions don’t always reflect demonstrable reality, particularly when you ask about how people feel. Asking about perceptions and focusing on an emotional component can give people explicit permission to detach their experience from what the actual evidence might show. And often, it’s likely our feelings that govern our behaviors, whether we’re talking about managing relationships or spending money.

About half (49%) of Americans say they feel worse about the state of the U.S. economy in general now compared to 12 months ago, according to the NerdWallet survey conducted in April. Just 26% feel better. Among the questions asked, this one garnered the strongest opinions — it had the lowest rate of people who neither felt better nor worse.

Twelve months before this survey, the economic indicators most people would encounter in daily living were pretty close to where they are now. Unemployment was a low 3.4%; now, it’s still low by historical standards, at 3.9%. Gas prices were relatively the same: $3.71 per gallon on average then and $3.73 now. One major improvement over that one-year period can be found in price growth, however. Inflation in April 2023 was near 5%. Now, it’s closer to 3.5%. In fact, wages are now growing faster than prices.

When asked to look more locally — how they feel about the state of their personal finances now versus 12 months ago — one-third (33%) of Americans feel better and 29% feel worse. Parents of minor children are more likely (39%) than non-parents (31%) to feel better.

What’s driving the disconnect?

The disconnect between how people feel about the economy at large and how they feel about their household finances seems counterintuitive. By most official measures, the economy is strong. If feelings or perspectives run contrary to that, one source of the negative sentiment could be personal experience. In other words, if I feel bad about the economy when the economy is doing well, maybe it’s because my personal financial situation is not so great. But a modest segment of Americans hold these two seemingly disparate feelings simultaneously: 18% of those who feel worse about the economy now than they did 12 months ago say they feel better about their personal finances over the same period.

There are many other possible explanations for the perception of a worsening economy, including:

1. We could be measuring the economy wrong (maybe it’s not doing as well as we think). The COVID-19 pandemic didn’t just shake the economy, it shook economic data too. This explanation might not be the most likely, however, as the people responsible for economic data are experts in their field. If someone’s going to get it right, it’s likely them. Data collection, benchmarking and seasonal adjustments have all been impacted and continue to be accounted for.

2. Exposure to negative stories in the news or social media could be coloring people’s outlook on the economy’s health. The last high inflation period was a relative lifetime ago, in the 1980s. Then, our primary sources of economic information came at regularly scheduled and limited intervals: in the morning newspaper or in front of the evening newscast, for example. Now, economic data is everywhere you look, translated by both experts and social media influencers alike. This consistent attention to the economy’s measurements could be having an outsized impact on our perception of its well-being.

3. The housing market could be playing an outsized role in overall economic perspectives. If there’s one section of the economy that is undoubtedly difficult, it’s the housing market. Under current conditions — high home prices, a paltry number of homes available for sale and high borrowing costs — even if someone has taken steps to position themselves to buy, they’ll be met with difficulties. Healthy household finances can only get you so far if you’re trying to buy a home in this unfriendly market, and confronting these roadblocks on the path to a long-term financial goal can be very discouraging.

4. We’re aware that even though we might be doing better personally, others aren’t so fortunate. Aggregate measures of the economy conceal a lot of nuance. Unemployment is low on a national scale, but people are still unemployed. Wage growth is outpacing inflation, but not everyone is receiving raises. Even if you personally aren’t experiencing any downside to this economy, knowing that others are may color your views. This isn’t necessarily a bad thing — empathy across the economy can drive meaningful community involvement and policies that improve the well-being of others.

What we shouldn’t do is assume that people just don’t understand the economy and write off the disconnect as immaterial. At some point, how we feel about the economy can impact how we act. It can affect decisions such as whether now’s a good time to buy a new car, invest in the stock market or start a new business. For business owners, it can impact hiring and investment decisions. And all of these spending and saving decisions can ultimately impact the health of the economy, feeding into official data. Consumer expenditures account for about two-thirds of total GDP, for example. So how we feel about things, no matter the driving force, can impact economic reality. And that makes this sentiment worth listening to.